-

28-09-2022

Bear Market Confirmed.. So Time to Start Buying!

U.S. stocks continued to fall Monday as the Dow Jones (ticker – US30) entered into the first bearish zone since the beginning of the pandemic, as investors consider current economic growth and the cost of Federal Reserve efforts to control inflation. Bear market is defined on Wall Street as a drop of 20% or more from a recent high. Traders will focus on the outlook for interest rates and possible weakness from the two consecutive periods of declines this year.

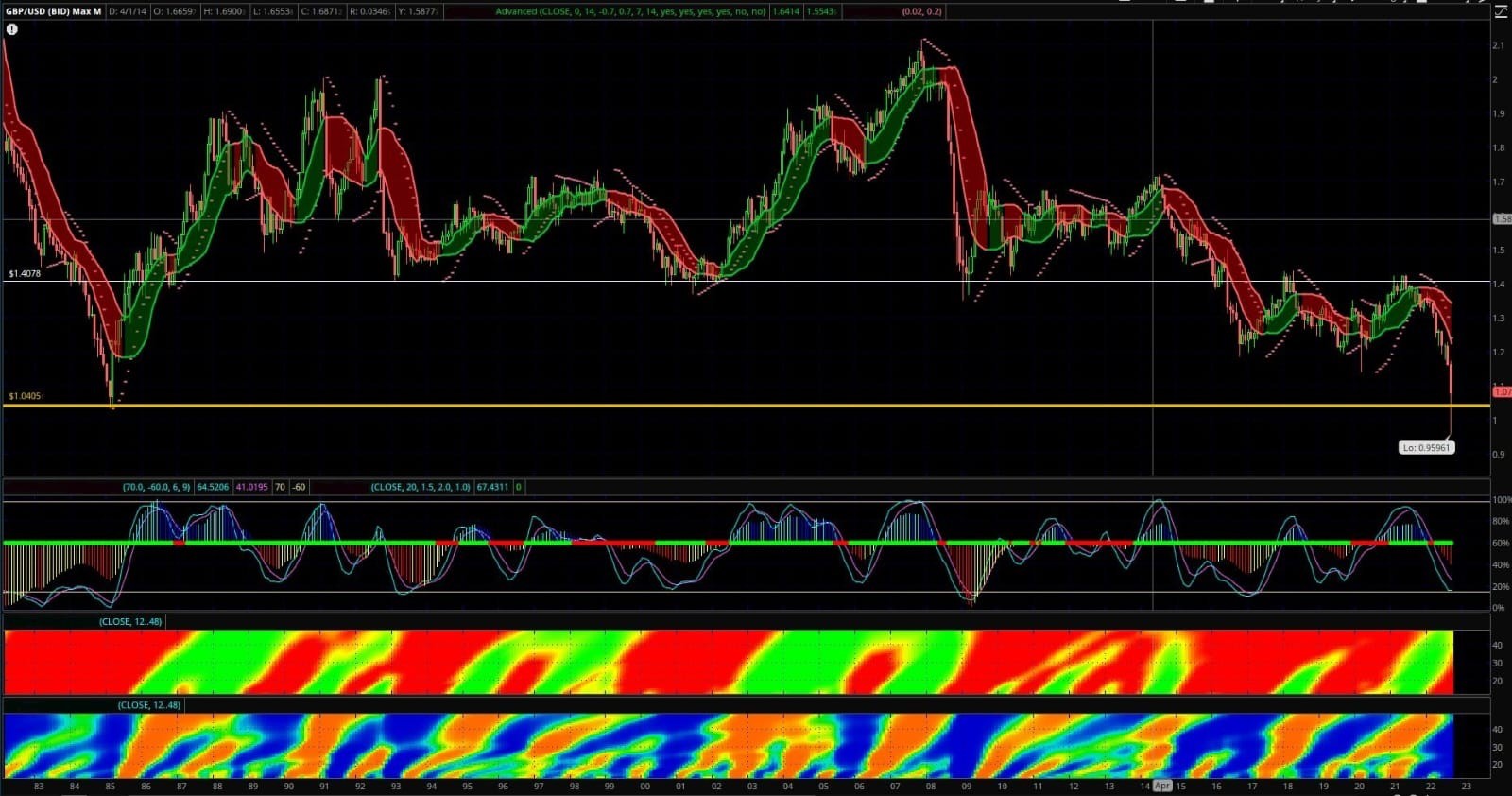

Last week, the Fed issued another big rate increase, and hinted that more large increases are likely to continue. U.S. government bond prices fell again, increasing yields. The yield on 10-year notes rose to 3.878%, which is the highest level since 2010. The U.S. dollar grows stronger, as higher interest rates drive the powerful dollar rally, which dropped the British Pound to it’s lowest price in 40 years! UK 2-year bond yields are presently higher than the 10-year yields!!

Asian markets fell yesterday, following the drop in U.S. markets on Friday. Oil prices continue to drop as traders predict that slow economic growth may lead to less fuel demand.

With all this uncertainty, I believe the market is nearing the bottom, and smart investors should prepare to begin DCA or “Dollar-Cost-Averaging” into strong US companies, tech stocks, and the GPB. Investors expect to see more volatility going into the end of 2022, but also great opportunities to create a strong financial foundation by entering the market at discounted prices. Please note the chart below showing the 40-year low of Sterling (GBP).