-

09-08-2022

Today’s Outlook

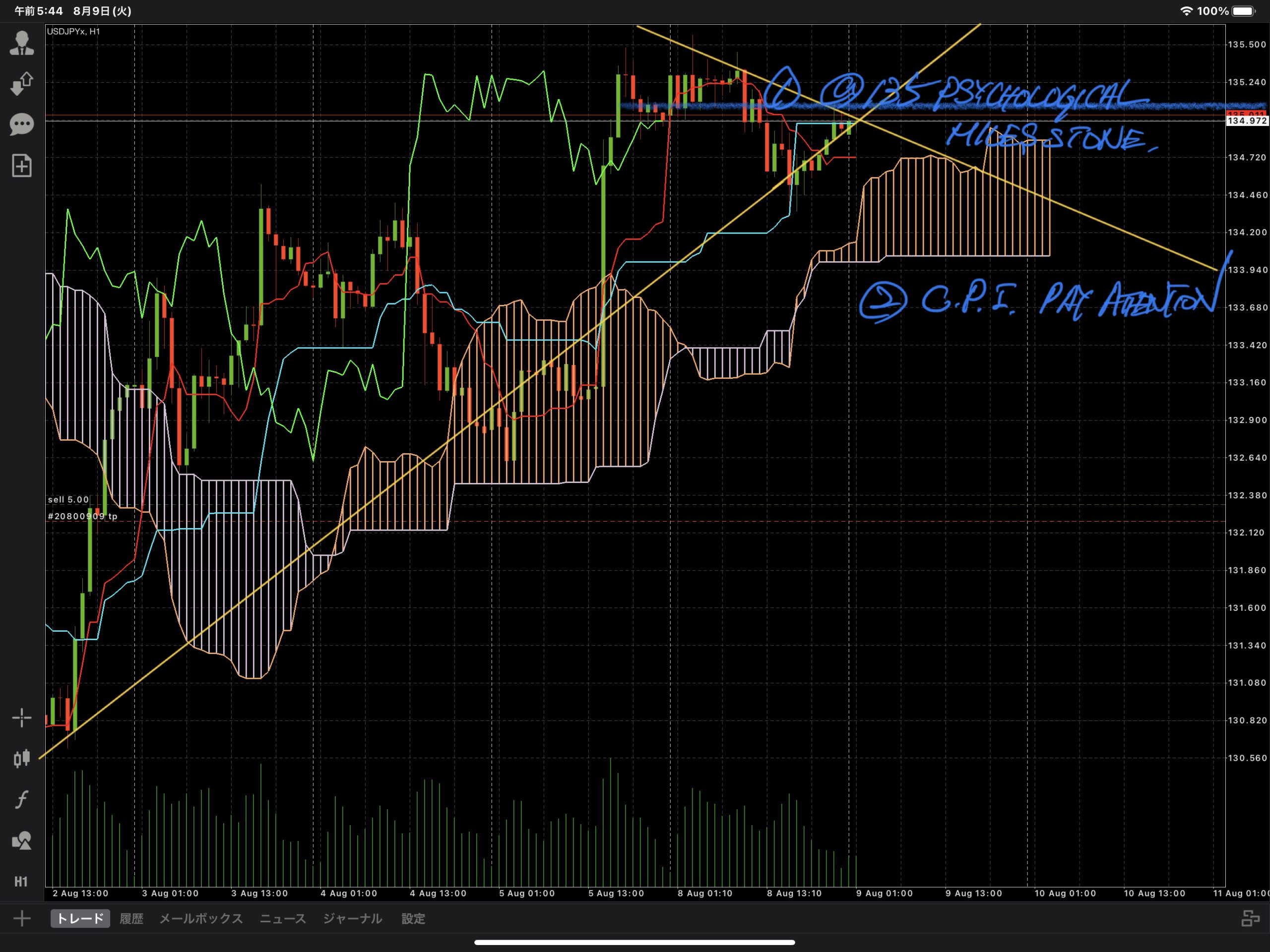

The dollar/yen exchange rate hit a 23-year, 10-month high of 139.40 on July 14th, and then fell back to 130.40 on August 2nd (a two-month low). With a series of hawkish remarks by U.S. Officials and a positive surprise in the US employment statistics, USD/JPY rose sharply to 135.55 at the beginning of the week on August 8th.

From a technical point of view, the chart is becoming a shape that impresses the strength of the sentiment, such as achieving the high price of 139.40 on July 14th and the half price of 134.90 from the low price of 130.40 on August 2nd in less than a week (after the end of climax selling) entering a recovery phase. The topside of the USD/JPY may be lighter than expected after large-scale loss cuts by short-term investors.)

From a fundamental’s perspective,

(1) recession concerns over the US economy have receded (concerns about a recession in the US economy, which spread after two consecutive quarters of negative growth in US GDP, have receded after last Friday’s US employment statistics), and

(2) Expectations of a 75bp rate hike will reignite at the next FOMC meeting in September (supported by a series of hawkish remarks by U.S. officials);

(3) The U.S. government and authorities are willing to tolerate a strong dollar (the U.S. is ready to tolerate a strong dollar that will help curb inflation).

Based on the above, we continue to forecast continued appreciation of the dollar-yen exchange rate as the main scenario. However, as important events such as the US July consumer price index (8/10) and the US July producer price index (8/11) will be held from the middle of the week onwards, a wait-and-see mood is likely to intensify today., the dollar-yen pair is likely to go up and down, but it will continue to be difficult to find a sense of direction. Although retail sales and an auction of US 3-year bonds are scheduled, it is highly possible that the direction of the dollar-yen exchange rate will not be determined for the above reasons.

Today’s expected range: 134.25-135.75

Analyzed by: Mr. Naoto Arase, Head of Fintech of PP Link Securities

Disclaimer:

PP Link Securities Co., Ltd. endeavors to ensure the accuracy and completeness of this research report. However, as the market is subject to change, the Company and our subsidiaries do not guarantee its completeness and accuracy, and the information is for reference only. Any person shall not regard such information as PP Link Securities Co., Ltd. on leveraged foreign exchange, precious metals, stocks, and other financial products to provide real quotes, suggestions, solicitation, and inducement of investment. Guests should be aware of the risks involved in the investment, the volatility of the investment market, and the risk of loss can be very big, guests must carefully consider their own financial situation and investment purposes, to decide the direction of investment and the kind of investment products that are suitable for their owns.