-

16-08-2022

Today’s Outlook

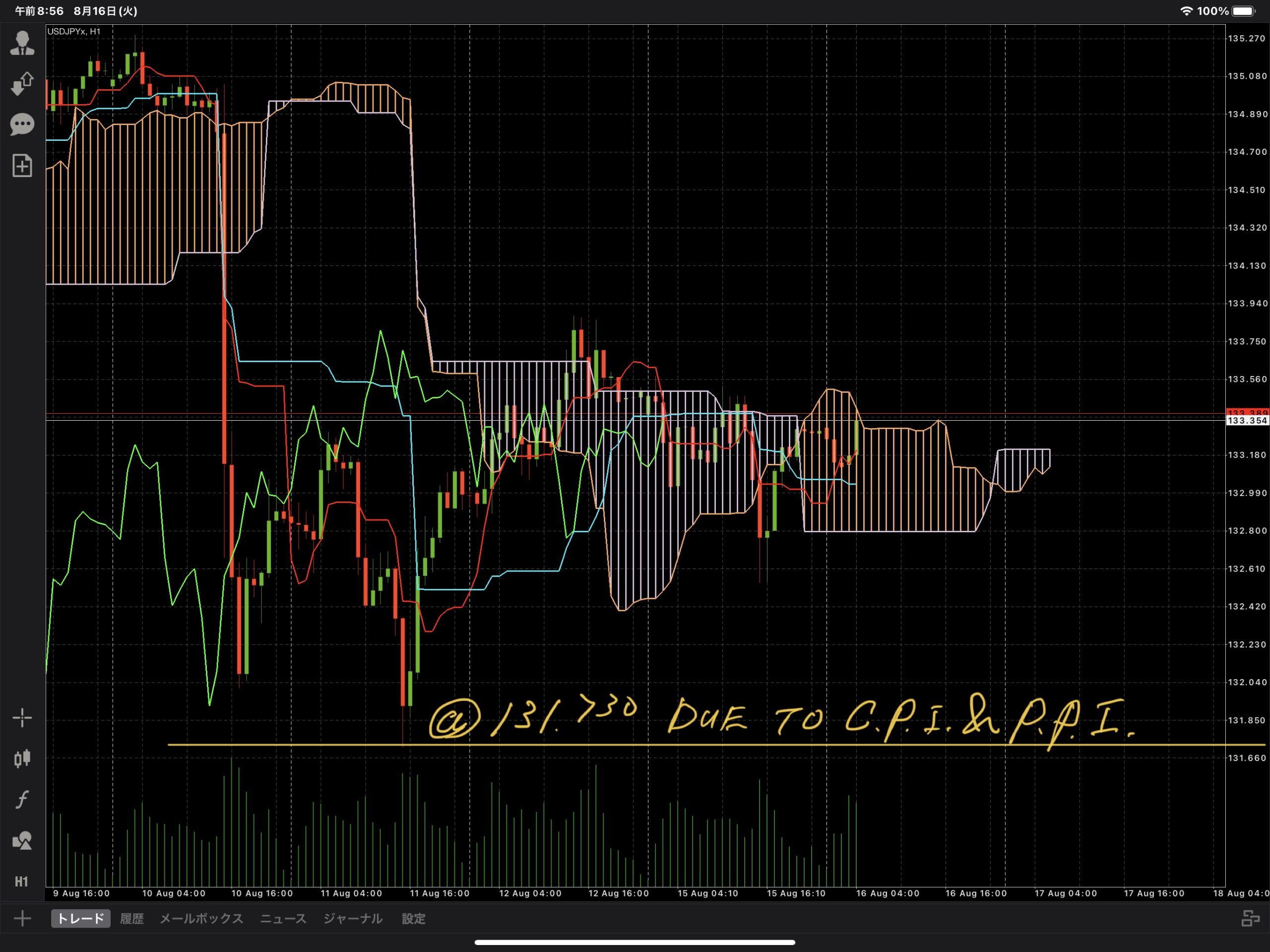

The dollar/yen pair temporarily widened its decline to 131.73 on August 11 in response to the slowdown in the US CPI and US PPI announced last week, but backed up to the lower limit of 131.68 and the August 2 low of 130.40. After the continued decline was blocked by the market, the price recovered to the 133 yen level from the weekend to the beginning of the week.

Having reconfirmed the firmness of the lower price, it is considered necessary to pay attention to the cyclical upside risk of the dollar-yen exchange rate this week.

From the fundamentals point of view,

(1) the expectation of a 75bp rate hike at the next FOMC meeting in September remains firmly rooted (as mentioned above, although the US CPI and US PPI announced last week have slowed down, US officials expect inflation to peak out).

(2) Bank of Japan’s continued monetary easing policy,

(3) Differences in the direction of monetary policy between Japan and the United States against the background of (1) and (2) above (dollar buying and yen selling due to the widening Japan-US nominal interest rate differential),

(4) There are factors suggesting a rise in the dollar-yen exchange rate, such as the attitude of the US authorities tolerating a strong dollar (a willingness to tolerate a strong dollar that can lead to the suppression of inflation).

In addition, the fact that the excessively accumulated short yen positions have decreased significantly after last week’s adjustment is also expected to lead to the creation of new dollar-yen long positions (U.S. Commodity Futures Trading Commission Open interest in the non-commercial sector of the IMM currency futures announced on August 12 was 25,032 contracts for yen short contracts, a significant decrease from 42,753 contracts in the previous week).

Today’s expected range: 132.50-134.00

Analyzed by: Mr. Naoto Arase, Head of Fintech of PP Link Securities

Disclaimer:

PP Link Securities Co., Ltd. endeavors to ensure the accuracy and completeness of this research report. However, as the market is subject to change, the Company and our subsidiaries do not guarantee its completeness and accuracy, and the information is for reference only. Any person shall not regard such information as PP Link Securities Co., Ltd. on leveraged foreign exchange, precious metals, stocks, and other financial products to provide real quotes, suggestions, solicitation, and inducement of investment. Guests should be aware of the risks involved in the investment, the volatility of the investment market, and the risk of loss can be very big, guests must carefully consider their own financial situation and investment purposes, to decide the direction of investment and the kind of investment products that are suitable for their owns.