-

12-07-2022

Today’s outlook

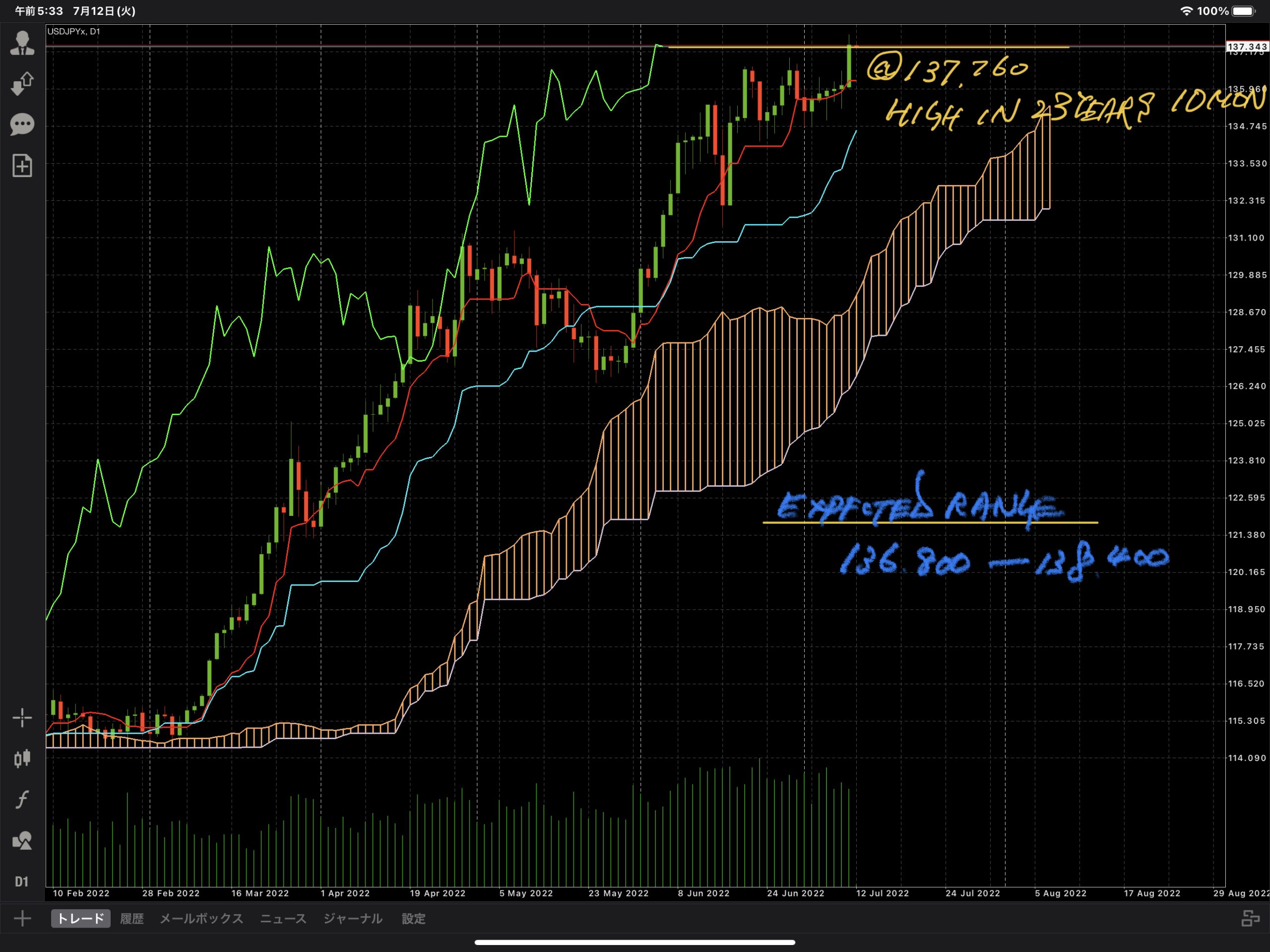

The dollar-yen pair broke above the latest high of 137.01, which was recorded on June 29, and has surged to 137.76, the highest in about 23 years and 10 months since September 1998. From a technical point of view, it can be judged that the formation is extremely strong, such as strong buying signals (such as Ichimoku Kinko Hyo SANYAKU turn around and bullish perfect order) are lit on all tenors from the upper leg to the lower leg.

From a fundamental point of view,

(1) hawkish tilt observation by the US Fed (last week, several US officials re-emphasized that “the attitude to prioritize inflation control over the economy”. US June ISM non-manufacturing business conditions index and the June employment statistics showed strong content also supported the observation of continuous significant rate hikes), and

(2) the Fed’s observation of prolonged monetary easing (Governor Kuroda said yesterday that “additional easing without hesitation if necessary” is hawkish. Re-emphasizing this stance), (3) Japan-US monetary policy disparity against the background of (1) and (2) above dollar buying and yen selling due to widening of the nominal interest rate difference between Japan and the United States.

(4) Observation of the depreciation of the yen by the Japanese people (the Liberal Democratic Party overwhelmingly in the election of the House of Councilors on the weekend → the view that the Japanese people accepted the depreciation of the yen at the moment is expanding), etc.

Based on the above, we will continue to anticipate the continued growth of the dollar-yen exchange rate as the main scenario (psychological milestone 140.00 is the next target).

Today, attention will be focused on the Japan-US Finance Ministers’ Meeting (Finance Minister Shunichi Suzuki and US Treasury Secretary Janet Yellen) starting at 15:45 Cambodian time. Market interest has shifted to the views of the two ministers on the “weak yen”, but as mentioned above, the US has shown its willingness to tolerate a stronger dollar for the time being, which will lead to inflation control. For this reason, it should be noted that the dollar-yen pair will surge after the Japan-US finance ministers’ meeting.

Today’s forecast range: 136.70-138.50

Analyzed by: Mr. Naoto Arase, Head of Fintech of PP Link Securities

Disclaimer:

PP Link Securities Co., Ltd. endeavors to ensure the accuracy and completeness of this research report. However, as the market is subject to change, the Company and our subsidiaries do not guarantee its completeness and accuracy, and the information is for reference only. Any person shall not regard such information as PP Link Securities Co., Ltd. on leveraged foreign exchange, precious metals, stocks, and other financial products to provide real quotes, suggestions, solicitation, and inducement of investment. Guests should be aware of the risks involved in the investment, the volatility of the investment market, and the risk of loss can be very big, guests must carefully consider their own financial situation and investment purposes, to decide the direction of investment and the kind of investment products that are suitable for their owns.