-

30-08-2022

U.S. dollar gains momentum slows, markets await this week’s non-farm payrolls

Fundamentals:

Yesterday, the U.S. dollar refreshed the high point in the past 20 years and then fell back. The overall upward momentum of the U.S. dollar has slowed down, but the overall upward structure remains intact; The fall of the US dollar gave gold a chance to breathe. Gold fell to around 1720 yesterday, stabilized and recorded a rebound. The final rebound was blocked at 1745 and fell back. The current trading volume is around 1735, and on the whole, the future trend of gold is more variable.

This week, investors will usher in the US non-farm payrolls data for August and the ISM manufacturing and non-manufacturing PMI data. The current overall market sentiment is relatively strong, waiting for the non-agricultural data to be released. Federal Reserve Chairman Powell’s hawkish remarks at the Jackson Central Bank Annual Meeting further increased the market’s expectations for a 75 basis point rate hike by the Fed in September. The current market’s probability of a 75 basis point rate hike in September is 72.5%. In addition, Powell made a hawkish speech, and the hawkish remarks were echoed by other Fed officials. During the day, investors need to pay attention to the JOLTs job vacancy data in the United States in July, and also pay attention to the speeches of the Fed officials. If the Fed officials continue to make hawkish remarks, it will strengthen the market’s expectations for the Fed to raise interest rates by 75 basis points in September, which will suppress the trend of gold prices.

Technical side:

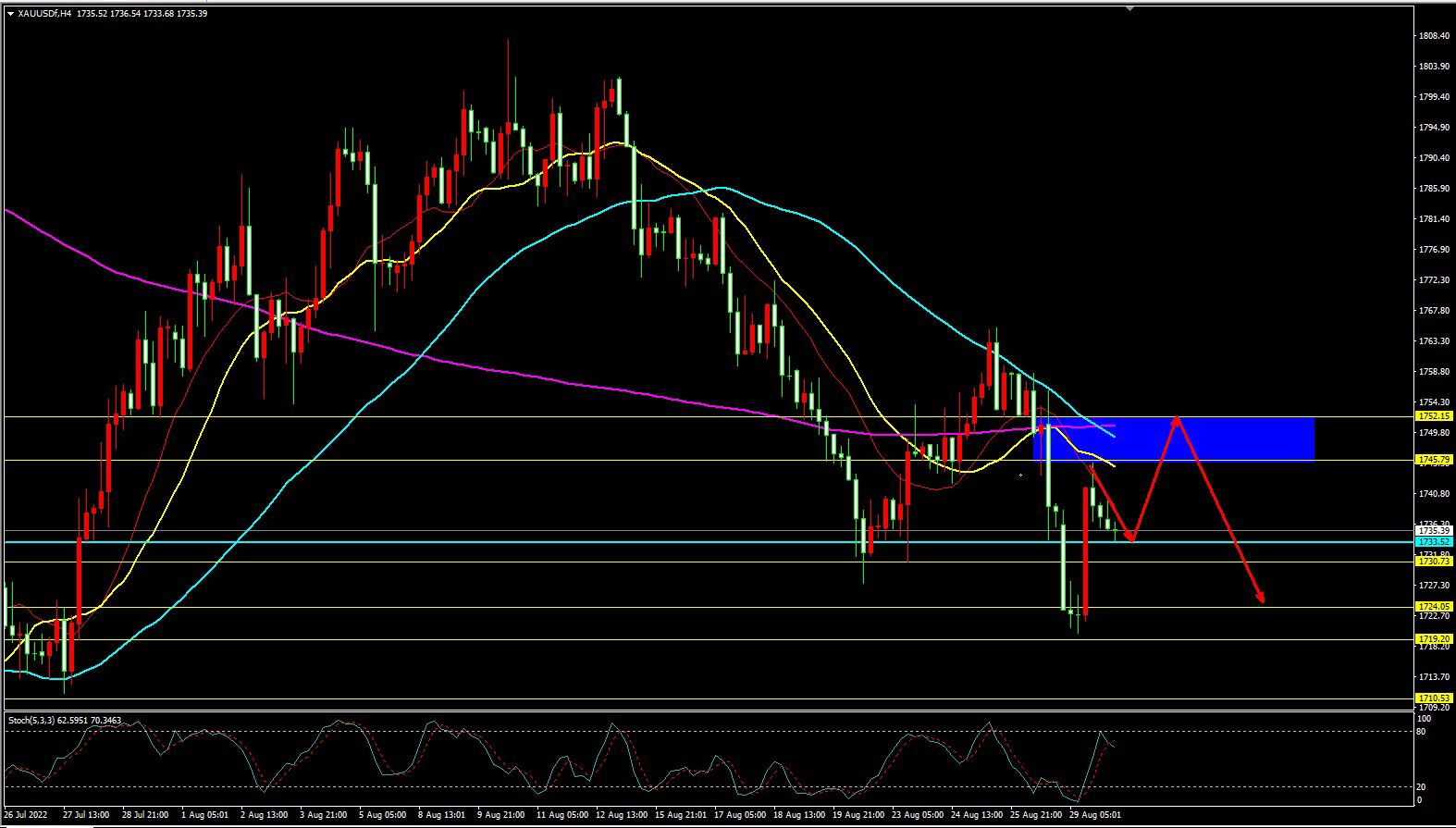

The overall shape of gold in the monthly cycle is still in a downward state, but the downward momentum has been reduced. In the weekly cycle, the overall trend of gold prices is still in a downward trend, and the downward momentum still exists. The daily cycle recorded a Doji K line yesterday. The shape shows that the overall mood of the market is relatively cautious, and there is a strong wait-and-see mood. The daily line has the need to enter the range and consolidate. The four-hour cycle has risen and fallen, and the short-term trend is weak. The short-term one-hour cycle entered a range-bound consolidation, but the momentum was weak. Intraday short-term trading focuses on resistance pressure: 1746/1752/1757; support position 1733/1730/1724/1719; on the whole, the US August non-farm payrolls data will be ushered in this week, and the overall market has a strong wait-and-see mood. Looking at the gold price is expected to remain in the 1752-1725 range for range-bound consolidation before the non-agricultural data is released. Intraday short-term trading can be carried out in this range to sell high and buy low, but the trend of the monthly weekly and daily cycle technical graphics shows that the overall trend of gold prices is on the downward trend. The first choice for the day is: the price rebounds in the 1745-1750 range, and the defensive is 1753, see 1735-1730-1724-1719-1710.

The above suggestions are only personal thoughts, for exchange reference only, investment is risky, and you need to be cautious when entering the market!