-

17-10-2022

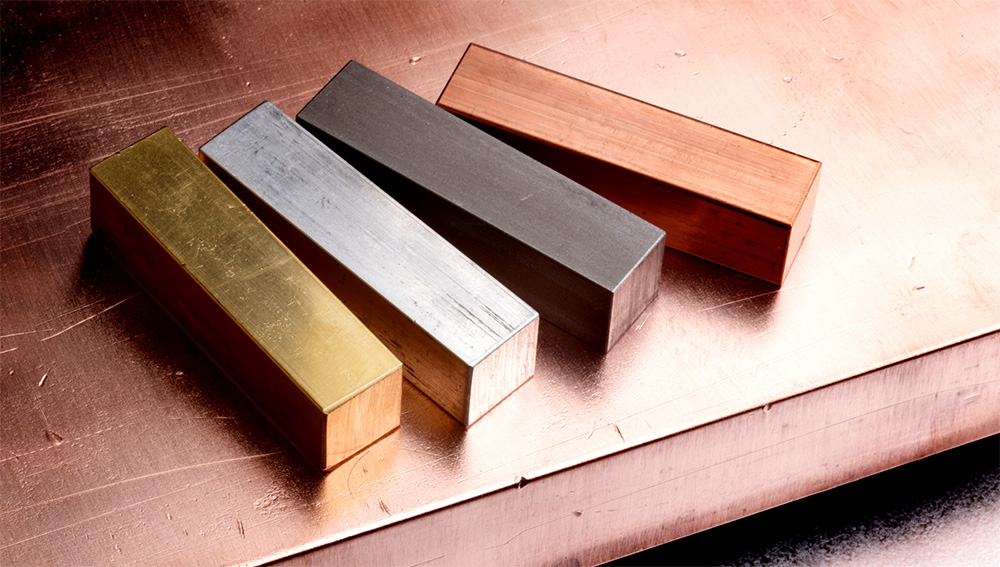

Gold under $ 1,650 and Copper awaits major production reports

Gold rallied higher on Monday but snapped below key support levels as markets feared further rate hikes by the US Federal Reserve as copper markets awaited quarterly production figures from the biggest miners. Some in the world that will arrive this weekend.

Bullion prices marked their worst week in two months as data showed that US inflation is likely to take longer to improve than expected. The reading boosted expectations of further inflation when the Fed meeting in November.

Markets are pricing in the near 100% chance that the Fed will raise interest rates by 75 basis points for the third straight month in November. US interest rate hikes at around 4%, their highest level since late 2007.

Spot Gold rose 0.1 percent to $ 1,646.02 per ounce, while futures rose 0.2 percent to $ 1,651.35 per ounce at 19:25 ET (23:25 GMT). Both devices fell more than 3% in the previous week.

The yellow metal is still under pressure from a strong dollar, which was on the lookout for a 20-year rally last month. US Treasury yields also traded at their highest level since the 2008 financial crisis.

Rising interest rates have hit gold prices this year while benefiting the dollar as the opportunity price of gold holdings has risen in line with lending rates. This trend has severely damaged the yellow metal of its security attraction, despite the worsening global economic outlook.

Among industrial metals, copper prices rose on Monday but remained at a two-year low amid slowing global economic activity.

Copper futures rose 0.5 percent to $ 3.4220 a pound. The price of the red metal rose 1% last week, benefiting from some weakness of the dollar and signs of tightening supply due to sanctions against Russia.

But most metals and industry partners may face new challenges in the coming months. China, the world’s largest importer of metals, has no plans to curb policy that destroys the economy without Kuwait, as signaled by President Xi Jinping during the 20th National Congress of the Communist Party of China. On Sunday.

Policies have halted economic activity in the world’s second-largest economy this year, severely undermining its interest in imports.

The focus this week is on third-quarter production reports from major miners BHP Group (NYSE: BHP) and Rio Tinto (NYSE: RIO) for additional signals on copper supply. Prices could benefit from possible supply shortages as exports of many Russian producers are hampered by US sanctions.

For today, gold trading continues to encourage investors to sell at the current price of 1653.00 or under $ 1666.00 per ounce. Will set profit at 1645.00 and set risk of $ 1677.00 per ounce.